The Detroit Lions have had an amazing resurgence of late. With a winning percentage of 62% over the past two seasons and coming just a drive short of the Super Bowl last year, much of their success has been due to the amazing collection of talent they have drafted over the past few seasons.

One of the players that has contributed to their recent success is defensive tackle Alim McNeill. Entering the final year of his rookie deal, the former third-rounder has improved in each of his three years in the NFL, culminating in a 32 tackle, five sack season in 2023.

McNeill’s ascension coincides with a surge in the defensive tackle market. This offseason five of the top 10 contracts for defensive lineman, as measured by APY, have been agreed to. This sets Wilkins up for a potentially big payday in the near future. But how near?

With three years under his belt, McNeill is eligible for an extension now. The Lions may choose to follow a path that the Eagles are pioneering by signing core players to extensions early to save in the long run. The Lions could try to extend McNeill and avoid catching the back end of an exploding market. But McNeill is an interesting case study. He may not want an extension because his production to this point in his career might cap his potential payout.

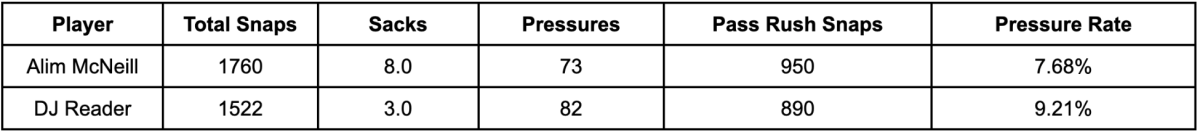

Here is a look at McNeill’s pass rush production over his first three years in the NFL compared to some of the other defensive tackles who signed this offseason:

McNeill ranks last in every single category. Williams has the lowest APY deal of the bunch at $21.5 million per year. That would represent an absolute ceiling for a potential deal for McNeill, and even then he would most likely struggle to achieve that number.

A good portion of McNeill’s value comes not just from his developing prowess as a pass rusher. He has also grown as a run defender, which is a skill that is a bit harder to define from a production standpoint. I tried looking for a player whose production was similar to that of McNeill’s. I found a very interesting comp. One that now hits pretty close to home for McNeill.

Reader has the more consistent pressure rate, but McNeill has finished more pressures, registering almost three times as many sacks. Reader is known more for his skills as a run defending nose tackle than as a pass rusher. McNeill stacks up with Reader better than you might think in that area.

Reader is more consistent, but McNeill has more splash plays, a similar number of tackles for loss and the same average depth of tackle.

Reader just signed with Detroit for two years and $22 million coming off of a significant injury. I doubt McNeill would want to extend for a similar APY that ranks 28th overall among his position group.

In order for McNeill to achieve a contract that is close to the top of the market he and his representation would need to sell the Lions that his 2023 is a better approximation of who he will be going forward. Extrapolating McNeill’s 2023 pass rush production over three years puts him in much better company with the original group he was compared to.

Now his pressure rate ranks second in the group while his total pressures match closely with Madubuike and Brown and his sacks slot right in between Williams and Wilkins.

Madubuike just received $24.5 million per year while Williams raked in $21.5 million per year. McNeill could try to reach with the midpoint on those two deals on an early deal at $23 million per year.

If Detroit counters with a Reader-plus deal of around $13 million per year there would be a wide range of $10 million between the two sides. The only way we see the two parties finding a consensus is if McNeill is extremely risk-averse and looking for immediate long-term security. Landing in the middle of those two figures would be an $18 million APY contract that would tie him with Jonathan Allen for the 13th highest contract at the position.

McNeill would consider this a win with a deal that is commiserate with a higher level of production than his career-to-date production would warrant. The Lions could see this as a win by getting him locked up early for a discounted rate from his recent trajectory.

Ultimately, we find this extension to be unlikely. But if the two parties were to come to an agreement this is what we would project.